Revamped OpenTuition site - visit and explore new features

22 April 2010

Got this email from OpenTuition.com:

OpenTuition.com is more social

We have updated the site with new and exciting features!

Forums and Groups are now merged into one!

So it is easy to join and stay in touch with other students who study for the same exam or have similar interests!

As always you can exchange your comments, ask questions and now you can also share your personal notes!

Every group can have their own documents!

To learn more about new features please visit this page

Course notes

All course notes are now available, now you can download them from the main site! Here are updated links!

Paper F1, Paper F2, Paper F3, Paper F4, Paper F5, Paper F6, Paper F7, Paper F8, Paper F9, Paper P1, Paper P2, Paper P3, Paper P4, Paper P5, Paper P7

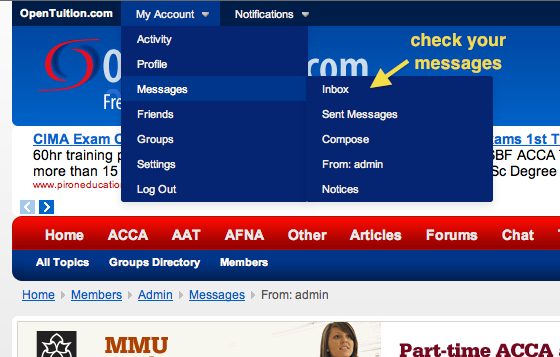

Login to the site for other updates >>>

Spread the word about OpenTuition.com

Are all your friends benefiting from our free resources?

Alert all your friends on facebook and other social networks!

Only with your help can we expand and produce more free materials for you!

Do not forget to share this email with your friends Read more...